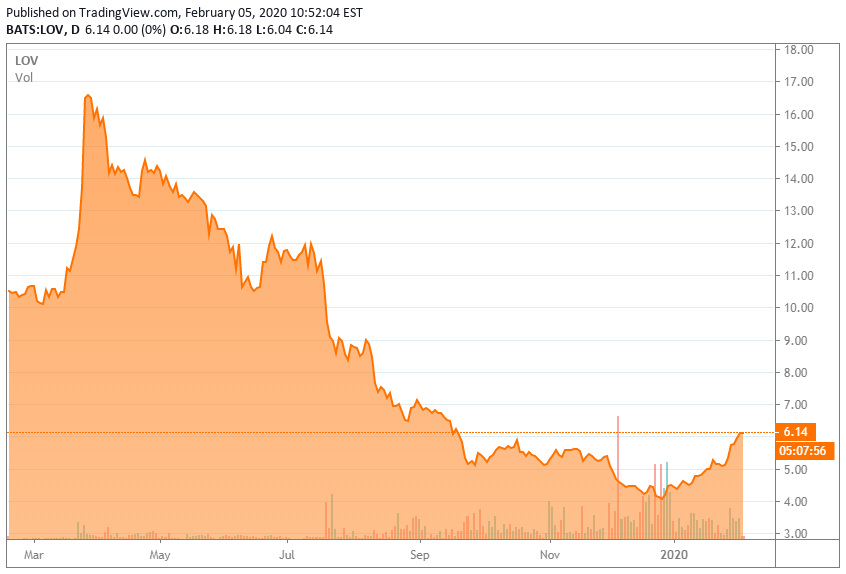

Zoosk Spark Networks

Posted By admin On 13/06/22

Berlin-based Spark Networks, the owner of niche dating app brands like Christian Mingle, Jdate, LDSsingles, Silver Singles, JSwipe and others, today announced it has acquired Match.com competitor Zoosk for a combination of cash and stock. The deal values Zoosk at approximately $258 million. Spark says it will issue 12,980,000 American Depositary Shares (ADS) to former. Jul 17, 2019 Online dating conglomerate Spark Networks announced its purchase of Zoosk for $258 million USD. The popular dating app was acquired with a combination of cash and stock, and Spark will have full ownership of Zoosk shares.

- The acquisition makes Spark the second-largest dating company in

North America in revenues - Global monthly paying subscribers increase to over 1 million

- Spark expects to achieve over

$50 million of Adjusted EBITDA in 2020 - Spark to have 26,010,365 American Depositary Shares ('ADSs') outstanding following the transaction

'Today's closing represents a remarkable milestone in Spark's continued evolution. Four years ago, we were a small German startup with no presence in

Spark Networks SE and Zoosk are not able to provide a reconciliation of this non-IFRS financial guidance to the corresponding IFRS measure without unreasonable effort because of the uncertainty. MoFo Advises Spark Networks on Acquisition of Zoosk. MoFo is representing its long-standing public company client Spark Networks SE (NYSE: LOV) on its combined cash and stock acquisition of Zoosk, Inc., which will create the second largest dating company in North America. The parties entered into a merger agreement on March 21, 2019, and the.

The new social discovery feature is expected to increase revenue and user engagement throughout Spark’s largest brand. Spark Networks SE, a leading social dating platform for meaningful relationships, announced that the company has begun to record revenue from Zoosk Live! A livestreaming service offered via a partnership with ParshipMeet Group.

Based on current financial trajectories and the synergies identified between the two entities, the acquisition is expected to deliver substantial shareholder value, with Adjusted EBITDA forecasted at over

'I have been very impressed by Jeronimo and his team during this process and I am very confident in their ability to execute the integration plan we prepared together, and make the new combined company even more successful, driving substantial value creation for all shareholders over the next 12 to 18 months,' said

Transaction Details

Under the terms of the merger agreement, Spark will acquire 100% of

Following the closing of the merger, Spark has 2,601,037 ordinary shares issued and outstanding underlying 26,010,365 ADSs, with former

Spark will issue 12,980,000 ADSs to former

The transaction closed following approval of

ABOUT

Spark Networks SE is America's second largest dating company, listed on the New York Stock Exchange American under the ticker symbol 'LOV', with headquarters in

Investors:

Chief Financial Officer

investor@spark.net

Press Enquiries:

press@spark.net

Zoosk Spark Networks Login

Non-IFRS Financial Metrics

Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, amortization, share-based compensation, impairment of intangibles, and non-recurring costs. Adjusted EBITDA is not a measure defined by IFRS. The most directly comparable IFRS measure for Adjusted EBITDA is net (loss)/profit for the relevant period. This measure is one of the primary metrics by which Spark evaluates the performance of its businesses, budget, and forecast and compensates management. Spark believes this measure provides management and investors with a consistent view, period to period, of the core earnings generated from ongoing operations and excludes the impact of items that Spark does not consider representative of its ongoing operating performance, including: (i) non-cash items such as share-based compensation, asset impairments, non-cash currency translation adjustments, (ii) one-time items that have not occurred in the past two years and are not expected to recur in the next two years, including severance, transaction advisory fees, and integration costs, and (iii) discontinued operations. Adjusted EBITDA should not be construed as a substitute for net loss (as determined in accordance with IFRS) for the purpose of analyzing Spark's operating performance or financial position, as Adjusted EBITDA is not defined by IFRS.

Zoosk Spark Network

Spark's Adjusted EBITDA expectation for the combined company in 2020 does not include certain charges and costs. The adjustments to EBITDA in these periods are generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA in prior quarters, such as (i) non-cash items such as stock-based compensation, asset impairments, non-cash currency translation adjustments related to an inter-company loan and (ii) one-time items that have not occurred in the past two years and are not expected to recur in the next two years. The exclusion of these charges and costs in future periods will have a significant impact on the combined company's Adjusted EBITDA.

Forward-Looking Statements

This document contains 'forward-looking statements' as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. All statements in this press release other than statements of historical fact are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause

View original content to download multimedia:http://www.prnewswire.com/news-releases/spark-networks-se-closes-zoosk-inc-acquisition-300878537.html

Spark Networks Plc Lov

SOURCE